中山大学管理学院会计系导师介绍:柯滨的内容如下,更多考研资讯请关注我们考研派网站的更新!敬请收藏本站。或下载我们的考研派APP和考研派微信公众号(里面有非常多的免费考研资源可以领取哦)[中山大学公共卫生学院导师介绍:唐小江] [中山大学公共卫生学院导师介绍汇总] [中山大学公共卫生学院导师介绍:肖勇梅] [中山大学公共卫生学院导师介绍:王庆] [中山大学公共卫生学院导师介绍:杨杏芬] [中山大学公共卫生学院导师介绍:杨燕]

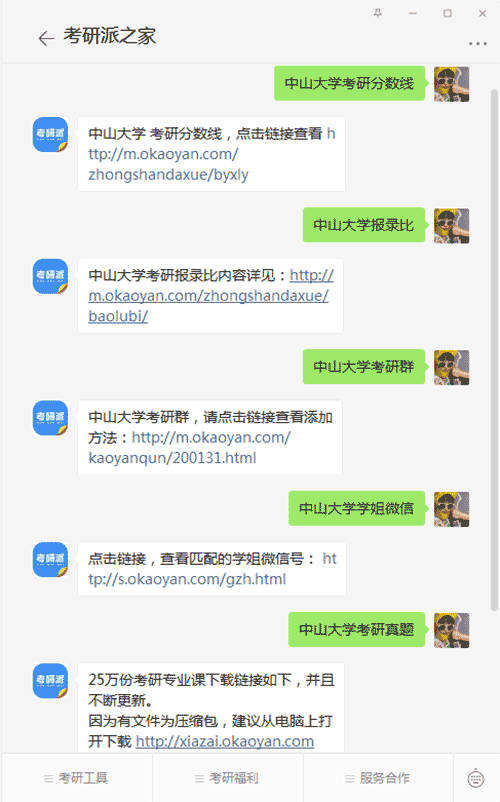

为你答疑,送资源

95%的同学还阅读了: [2022中山大学研究生招生目录] [中山大学研究生分数线[2013-2021]] [中山大学王牌专业排名] [中山大学考研难吗] [中山大学研究生院] [中山大学考研群] [中山大学研究生学费] 中山大学保研夏令营 中山大学考研调剂2022最新信息 [中山大学研究生辅导] [考研国家线[2006-2021]] [2022年考研时间:报名日期和考试时间]

中山大学管理学院会计系导师介绍:柯滨正文

个人详细介绍:

教育背景:

Pennsylvania State University; PhD - Michigan State University

BA - The Institute of International Relations, China; MS -

学术经历:

06/2010-present Professor, Division of Accounting, Nanyang Technological University

07/2009-12/2010 Professor, Department of Accounting, Penn State University

07/2003-06/2009 Associate Professor, Department of Accounting, Penn State University

07/1999-06/2003 Assistant Professor, Department of Accounting, Penn State University

08/1995-06/1999 Teaching and research assistant, Michigan State University

08/1992-06/1994 Research assistant, Penn State University

出版物:

期刊论文:

Bin Ke, Kathy Petroni, and Yong Yu. (2008). The effect of Regulation FD on transient institutional investorsa€? trading behavior. Journal of Accounting Research, 46(4), 853-883.

Steven Huddart, Bin Ke, Charles Shi. (2007). Jeopardy, Non-Public Information, and Insider Trading Around SEC 10-K and 10-Q Filings. Journal of Accounting and Economics, 43, 3-36.

Steven Huddart, Bin Ke. (2007). Information asymmetry and cross-sectional determinants of insider trading. Contemporary Accounting Research, 24(1), 195-232.

Jere Francis, Bin Ke. (2006). Non-audit fee disclosures and the market valuation of earnings surprises. Review of Accounting Studies, 11(4), 495-523.

Bin Ke, Yong Yu. (2006). The effect of Regulation FD on transient institutional investors’ trading behavior. Journal of Accounting Research, 2008, 46 (4), 853-883.

Bin Ke, Santhosh Ramalingegowda. (2005). Do Institutional investors exploit the post-earnings announcement drift?. Journal of Accounting and Economics, 39(1), 25-53.

Bin Ke, Kathy Petroni. (2004). How informed are actively trading institutional investors? Evidence from their trading behavior before a break in a string of consecutive earnings increases. Journal of Accounting Research, 42(5), 895-927.

Bin Ke. (2004). Discussion of a€?How Banksa€? Value-at-Risk Disclosures Predict their Total and Priced Risk: Effects of Bank Technical Sophistication and Learning over Time,a€?. Review of Accounting Studies, 9(2-3), 295-299.

Bin Ke, Steven Huddart, Kathy Petroni. (2003). What insiders know about future earnings and how they use it: evidence from insider trades. Journal of Accounting and Economics, 35(3), 315-346.

Charles Enis, Bin Ke. (2003). The Impact of the 1986 Tax Reform Act on Income Shifting from Corporate to Shareholder Tax Bases: Evidence from the Motor Carrier Industry. Journal of Accounting Research, 41(1), 65-88.

Anne Beatty, Bin Ke, Kathy Petroni. (2002). Differential Earnings Management to Avoid Earnings Declines Across Publicly and Privately-held Banks. The Accounting Review, 77(3), 547-570.

Bin Ke. (2001). Taxes as a Determinant of Managerial Compensation in Privately Held Insurance Companies. The Accounting Review, 76(4), 655-674.

Bin Ke, Kathy Petroni, Doug Shackelford. (2000). The Impact of State Taxes on Self-Insurance. Journal of Accounting and Economics, 30(1), 99-122.

Bin Ke, Kathy Petroni, Assem Safieddine. (1999). Ownership Concentration and Sensitivity of Executive Pay to Accounting Performance Measures: Evidence from Publicly and Privately-Held Insurance Companies. Journal of Accounting and Economics, 28(2), 185-209.

Bin Ke, Edmund Outslay, Kathy Petroni. (1998). Taxes as a Determinant of Foreign-Owned Property-Liability Insurersa€? Investment Strategies in the United States. Journal of the American Taxation Association, 20, 25-36.

工作论文:

1. Do Equity-Based Incentives Induce CEOs to Manage Earnings to Report Strings of Consecutive Earnings Increases?

2. The Effect of Investment Horizon on Institutional Investors’ Incentives to Acquire Private Information on Long-Term Earnings, with Santhosh Ramalingegowda and Yong Yu.

3. Why don’t analysts use their earnings forecasts in generating stock recommendations?, with Yong Yu.

4. Home country investor protection, ownership structure and cross-listed firms’ compliance with SOX-mandated internal control deficiency disclosures, with Guojin Gong and Yong Yu.

5. Informed trading by corporate executives and shareholder value, with Katherine Gunny and Tracey Zhang.

6. Does managerial stock option compensation increase shareholder value in state-controlled Chinese firms listed in Hong Kong?, with Zhihong Chen and Yuyan Guan.

7. Externalities of disclosure regulation: The case of Regulation Fair Disclosure, with Michael Crawley and Yong Yu.

8. Small Negative Earnings Surprises and Transient Institutions’ Trading Behavior, with Gang Hu and Yong Yu.

9. Does granting minority shareholders direct control over corporate decisions help reduce value decreasing corporate decisions in firms with concentrated share ownership? A natural experiment from China, coauthored with Zhihong Chen and Zhifeng Yang.

学术及社会兼职:

Editor, The Accounting Review, June 1, 2011-May 31, 2014

Associate editor, Asian Pacific Journal of Accounting and Economics, 2007-2010

Consulting editor, China Journal of Accounting Research, 2007-present

Editorial board member, Journal of American Taxation Association, 2002-2005

Editorial board member, The Accounting Review, 2004-present

Editorial board member, The International Journal of Accounting, 2008-present

Advisory board member, Accounting Research in China (English) published by the Accounting Society of China, 2009-present

Ad hoc reviewer for

American Accounting Association, Financial Accounting and Reporting Section

Financial Accounting and Reporting Section mid-year meeting

Hong Kong Government’s Research Grant Council

Contemporary Accounting Research

International Journal of Accounting

Journal of Accounting, Auditing and Finance

Journal of Accounting and Economics

Journal of Accounting and Public Policy

Journal of Accounting Research

Journal of American Taxation Association

Journal of Finance

Journal of Risk and Insurance

Pacific-Basin Finance Journal

Quarterly Journal of Business and Economics

Review of Accounting Studies

The Accounting Review

Member of the Program Committee for the First (2011) Journal of International Accounting

Research Conference (Xiamen, China)

AAA Distinguished Contributions to Accounting Literature Award Selection Committee 2010-2011

Invited faculty panelist, the New Faculty Consortium (2009 and 2010), Leesburg, Virginia

Co-chair, the conference committee of the Inaugural Chinese Accounting Professors’ Association of

North America research conference (Shanghai), 2008

Chair, the junior faculty mentoring program, the Chinese Accounting Professors’ Association

of North America, 2008, 2009

Director, Chinese Accounting Professors’ Association of North America, 2010-2014

President, Chinese Accounting Professors’ Association of North America, 2008/2009

President-Elect, Chinese Accounting Professors’ Association of North America, 2007/2008

Member, the Competitive PhD Dissertation Award Committee, the International Symposium on Chinese firm management, National Taiwan University, 2007

Vice President, Chinese Accounting Professors’ Association of North America, 2006/2007

Chair, the Competitive PhD Dissertation Award Committee, the 2nd International Symposium on

Chinese Accounting, Finance and Management, Cardiff University, 2006

Member, the 2003-2004 American Taxation Association Research Resources and Methodologies

Committee

Member, the 2003 Journal of American Taxation Association Conference Committee

Member, the 2002 American Taxation Association Doctoral Dissertation Award Committee

Invited Research Presentations

2011

University of New South Whales

Chinese University of Hong Kong

Xiamen University

National University of Singapore

2010

Rochester University

MIT

Boston College

Boston University

Michigan State University

Xiamen University

Shanghai Jiaotong University

Accounting research conference organized by the Shanghai University of Finance and Economics and

the Hong Kong Polytechnic University (keynote speaker)

The 9th International Symposium on Empirical Accounting Research in Xi’an (keynote speaker)

Nankai University

International Research Symposium on The Detection and Control of Accounting Fraud in Listed

Companies organized by the Tianjin University of Finance and Economics (keynote speaker)

American University

University of Minnesota Annual Empirical Conference

2009

University of Alberta

Georgetown University

Baruch College

Nanyang Technological University

Financial Accounting Standards Research Initiative roundtable (online)

2008

Cornell University

University of Kentucky

University of Oregon

City University of Hong Kong

Arizona State University

National University of Singapore

Chinese University of Hong Kong

Hong Kong University of Science and Technology

Singapore Management University

2007

Northwestern University

University of Houston

SUNY-Binghamton

University of Missouri-Columbia

Texas Christian University

City University of Hong Kong

Chinese University of Hong Kong

Beijing University

Sun Yatsen University (China)

Nanyang Business School

University of Hong Kong

Seoul National University

American Accounting Association Annual meeting

Seventh Accounting and Finance Conference at Xiamen University

2007 Asian Finance Association Conference

2006

5th China international empirical accounting research conference

University of Texas at Austin

University of Texas at Dallas

The American Accounting Association Annual Meeting

Hong Kong University of Science and Technology

2005

Chinese University of Hong Kong

Washington University in St. Louis

Hong Kong University of Science and Technology summer symposium

The Inaugural Asia Pacific Corporate Governance Conference (Hong Kong)

Hong Kong University

2005 China International Conference in Finance (Kunming, China)

The American Accounting Association Annual Meeting

Nanyang Business School

Singapore Management University

The China Accounting Professors Association Annual Meeting (Beijing)

2004

Contemporary Accounting Research Annual Conference

Georgia State University

University of Chicago

University of Colorado at Boulder

Ohio State University

2003

Wharton School

UNC-Chapel Hill

London Business School

14th Annual Conference on Financial Economics and Accounting

Duke University

University Of Cincinnati

University Of California Los Angeles

Beijing University

The American Accounting Association Annual Meeting

2002

The American Accounting Association Annual Meeting

The Big 10+ Research Conference

University Of California-Berkeley

MIT

University Of Michigan

Michigan State University

Carnegie-Mellon University

George Washington University

Tsinghua University (China)

People’s University (China)

Fudan University (China)

The Shanghai National Accounting Institute (China)

获奖情况及荣誉称号

Chang Jiang Scholar awarded by China’s Ministry of Education and

the Li Ka Shing Foundation 2010

Best paper award, the 2007 Asian Finance Association annual meeting 2007

Best paper award, the 5th China International Empirical Accounting Research Conference 2006

Andersen Foundation Doctoral Dissertation Fellowship 1998

Doctoral Scholarship Award, Department of Accounting, Michigan State University 1998

First Place, The First Graduate Student Research Recognition Competition,

Business/Social Science Section, Michigan State University 1998

Big Ten Doctoral Consortium Fellow 1998

Doctoral Internationalization Consortium in Accounting 1998

University Outstanding Student Award, the Institute of International Relations 1986-89

联系方式:

系 所: 会计学系

办公电话: 暂无数据

手机号码: 暂无数据

E-mail: KEBIN@ntu.edu.sg

详细地址: 暂无数据

添加中山大学学姐微信,或微信搜索公众号“考研派之家”,关注【考研派之家】微信公众号,在考研派之家微信号输入【中山大学考研分数线、中山大学报录比、中山大学考研群、中山大学学姐微信、中山大学考研真题、中山大学专业目录、中山大学排名、中山大学保研、中山大学公众号、中山大学研究生招生)】即可在手机上查看相对应中山大学考研信息或资源。

本文来源:http://m.okaoyan.com/zhongshandaxue/daoshi_475634.html