厦门大学王亚南经济研究院金融学老师:赵宏飙的内容如下,更多考研资讯请关注我们考研派网站的更新!敬请收藏本站。或下载我们的考研派APP和考研派微信公众号(里面有非常多的免费考研资源可以领取哦)[厦门大学经济学院金融系导师:朱孟楠] [厦门大学经济学院金融系导师:郑荣鸣] [厦门大学经济学院金融系导师:林宝清] [厦门大学经济学院金融系导师:陈蓉] [厦门大学经济学院金融系导师:郑振龙] [厦门大学经济学院金融系导师:元惠萍]

为你答疑,送资源

95%的同学还阅读了: [2022厦门大学研究生招生目录] [厦门大学研究生分数线[2013-2021]] [厦门大学王牌专业排名] [厦门大学考研难吗] [厦门大学研究生院] [厦门大学考研群] [厦门大学研究生学费] 厦门大学保研夏令营 厦门大学考研调剂2022最新信息 [厦门大学研究生辅导] [考研国家线[2006-2021]] [2022年考研时间:报名日期和考试时间]

厦门大学王亚南经济研究院金融学老师:赵宏飙正文

金融学助理教授

英国伦敦政治经济学院统计学(数理金融方向)博士

电话:

电子邮件:hongbiao.z(at)gmail.com

办公室:经济楼D302

个人主页:http://hongbiaozhao.weebly.com/

►个人简介

Research Interests

Contagion risk in banking, finance, insurance and economics

Dependence structure modelling via copulas and point processes with contagion

Portfolio credit risk management and strategy: pricing, hedging, rating; interaction of market and credit risk; economic capital

Education

Department of Statistics, London School of Economics—U.K.

PhD in Statistics (Mathematical Finance) 10/2008 - 10/2012

– Thesis: "A Dynamic Contagion Process – Modelling Contagion Risk in Finance and Insurance"

Advisor: Dr. Angelos Dassios

Committee: Prof. Andreas Kyrprianou and Dr. Umut Cetin

Warwick Business School, University of Warwick—U.K.

MSc in Financial Mathematics (Distinction) 9/2006 - 9/2007

– Thesis: "Credit Risk Models and Implementation", Distinction, supervised by Prof. Anthony Neuberger and

Prof. Stewart Hodges, sponsored by Paternoster

– Modules: Stochastic Methods, Asset Pricing, Numerical Methods Matlab & C++, Time Series Analysis,

Derivative Securities, Economic Analysis, Statistical Methods, Finance & VBA, Optimisation, etc.

Department of Mathematics, Zhengzhou University—China

BSc in Mathematics and Applied Mathematics (Top 5%) 9/2002 - 7/2006

Experience

National University of Singapore—Singapore

Research Fellow at Risk Management Institute 11/2012-05/2013

– Develop quantitative credit risk models for credit rating system and corporate default forecasts.

London School of Economics—London

Teaching Assistant 10/2009-6/2011

– Taught Class ST102 Elementary Statistical Theory for two groups of first-year undergraduates.

– Ran Help Session ST202 Probability, Distribution Theory and Inference for second-year undergraduates.

– Assistant examiner on statistics for the University of London International Programmes.

Paternoster (now Goldman Sachs)—London

Investment Analyst (Quantitative) at Investment Strategy Group 6/2007-12/2008

– Developed a robust stress-test model of portfolio credit risk based on stochastic processes, copulas and Monte

Carlo simulation for economic capital required by FSA; achieved 2.22% (£30 million) capital relief.

– Calibrated and analyzed time series models on iBoxx/iTraxx datasets.

– Analyzed recovery rates, Gilt/swap rates, default/liquidity risk premium, implied/historical default intensities.

– Executed risk scenario analysis and loss distribution simulation for CDS and bespoke CDO.

– Implemented quantitative trading strategy analysis: comparison between strategies of buy/hold and downgrade/sell.

– Performed bootstrap historical simulation from Moody’s data to obtain default probabilities.

– Built Paternoster’s Adjusted Credit Rating System based on spot-market yield data, which was presented to FSA chairman Lord Adair Turner on 15/5/2008 and received excellent comments.

►研究成果

Published Papers

"A Dynamic Contagion Process", with Angelos Dassios

- Advances in Applied Probability, 43(3), 814-846, 2011

"Ruin by Dynamic Contagion Claims", with Angelos Dassios

- Insurance: Mathematics and Economics, 51(1), 93-106, 2012

"Exact Simulation of Hawkes Process with Exponentially Decaying Intensity", with Angelos Dassios

- Electronic Communications in Probability, 18(62), 1-13, 2013

"A Risk Model with Delayed Claims", with Angelos Dassios

- Journal of Applied Probability, 50(3), 686-702, 2013

"A Markov Chain Model for Contagion", with Angelos Dassios

- Risks, 2(4), 434-455, 2014

Working Papers

"Portfolio Credit Risk of Default and Spread Widening", 2011

- awarded the First Prize of the Deutsche Bank Award in Financial Risk Management and Regulation, 2012

- in Proceedings of Australasian Finance and Banking Conference, 2011

►研究项目

国家自然科学基金项目(71401147,管理科学部,2015-2017)

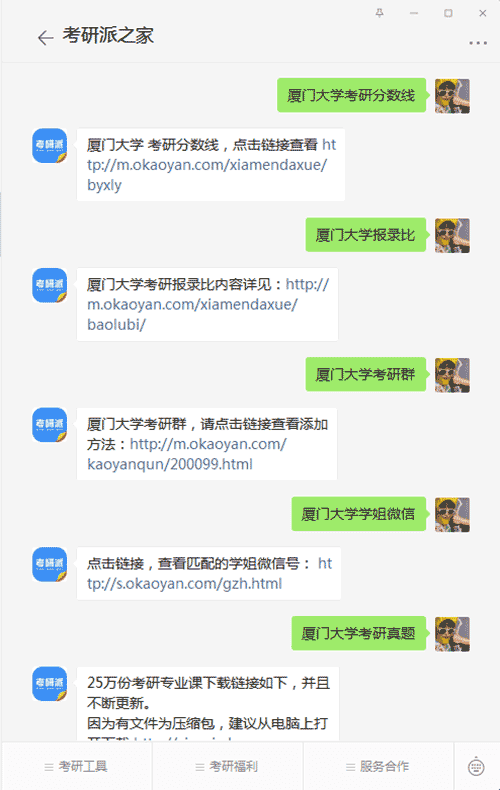

添加厦门大学学姐微信,或微信搜索公众号“考研派之家”,关注【考研派之家】微信公众号,在考研派之家微信号输入【厦门大学考研分数线、厦门大学报录比、厦门大学考研群、厦门大学学姐微信、厦门大学考研真题、厦门大学专业目录、厦门大学排名、厦门大学保研、厦门大学公众号、厦门大学研究生招生)】即可在手机上查看相对应厦门大学考研信息或资源。

本文来源:http://m.okaoyan.com/xiamendaxue/daoshi_496100.html